“I have never decided by voting.”

Murat Ulker

If you ask me, sometimes it is a duty, at other times it can be a phase of life, but it is undoubtedly a great responsibility. These days, I’m almost exclusively a board member. I remember receiving my very first proposal from my father’s friend whom I called ‘uncle’. He was a successful character in the 80s, he was someone with a massive overseas network. He had established a ‘foreign capital based’ Foreign Trading Company which was the trend at that time; he offered me, at early twenties a paid membership on the board of directors. After a few meetings, I realized that I must be in the field working actively. So I resigned from my position and of course, returned all payments.

Meanwhile, if we don’t take into account the superficial board of directors of family-owned companies as well as the decisions of the board of directors which were passed around and the signatures made to honor previous approvals, my position consisted of nothing more than answering questions regarding my performance at directors’ meetings, explaining what I was dealing with, and all my efforts towards seeking approvals. In those years of the early 90s, I was General Manager of Ulker and had a foreign partnership and its boards of directors’ meetings were held in two languages (Turkish/English). At that time, we didn’t even have a budget except in the boss’s mind. We lived between two or even three-digit annual inflation and devaluations. Years later, the boss, my dear father told me to investigate how best to organize our structure, management, and shareholding of the group. After several consultations with experts, he accepted my proposal. Yildiz Investment Company was established as a holding company and production was organized under the existing companies according to their specialization and businesses such as R&D, sales, procurement, and import/export are organized as several companies, managed individually as arm’s length commercial activities. As for ownership, it would be divided between my sister and myself, half and half. But I asked for a little more, so I’ll stay true to my word. This is how Yildiz Holding was established.

We had an Executive Board that met every week, including professionals. Although Sabri bey had wanted it so, we could not get an external member onto the Holding’s board of directors, however, we still held regular meetings with an agenda and paperwork. Sabri beys’ meticulousness and principles regarding meetings were known by everyone (1). Let’s leave our legendary Executive Board for another time and turn our focus to boards.

I have been mentoring for YKKD for the last few years, as we raise independent women board members. Therefore, on occasion, I read and research on the subject. In 2011, while looking through the book of Independent Board Membership on page 74, I read an analogy by the then Chairman of Dogus Automotive Board of Directors, Aclan Acar. He wrote: “Creating the

infrastructure for a company to move from the past to the future is necessary. This can be realized with a Board of Directors which serves as the brains of a company. If an organism’s brain is not working, but its arms and legs work, it still will not achieve efficiency” (2).

Corporate management is the management of the company and its management through the board is called corporate governance.

For nearly 30 years, in Turkey and abroad, both in public and non-public, I have served as a member and even as chairman on the boards of companies I am a shareholder of, and I’m still doing this. I took part in the creation of some of these management boards, while in some I worked as a member, later I became chair, or even later, I witnessed succession.

Especially at boards, company scandals that sometime left victims of shareholders and society at the beginning of the 2000s considerably changed the rules in the work of the boards of directors, namely governance and their principles. Creating a long-term value and acting

responsible, ethical behavior were subjects considered important in their meetings. (Transparency), in particular, being fair to all stakeholders (equitable treatment) and principles regarding being accountable (accountability) gained greater importance after these scandals. Laws and regulations were changed in this regard (3). The January 24th decisions made by Turkey to create the free market economy in 1980 led to a great crisis for bankers between 1981 and 1982. I was at the university then and I know this from my father; what measures were taken by the government and how the market was affected. In the 1990s in Turkey, a series of decisions were made that provided financial liberalization, linking Turkey’s economy with the world economy, and those decisions still affected the company’s management and board of directors in Turkey. Therefore, especially in the 2000s, when the scandals in the USA exploded, we were no strangers to the proposed principles. With the acceptance of the New Commercial Code in the 2010s, the Capital Markets Board issued the Communiqué on Corporate Governance Principles, and since 2012 public companies have lived with the independent member revolution in their board of directors.

I have accumulated a lot of experience in the establishment and operation of boards.

Since I have worked as a chairman and a member of these boards in different sectors, and with many different people, I can now both observe and feel which management style is being used and how it performs. There is no doubt that management or governance of a company by a board of directors is always and has always been a sensitive issue. Now, with the complexity of issues, and technology playing an even more important role in our lives, it has become a very difficult job. The reason for this is that there is an increase in the number of environmental risks to be overseen by a board of directors. Consider the Covid19 pandemic crisis that we are living in at the moment, forget about companies, no government could calculate the risks of this crisis in advance and take precautions.

The cover of The Economist magazine dated June 27, 2020, is “The next disaster and how we will survive” (4). The threats of the future in the article are asteroids, volcanic and solar eruptions. Thank goodness the article, in this respect, does not discuss the duties imposed on companies

but rather how governments are in the development of an early warning system. But of course, even talking about all these risks, companies will still be affected because of their markets. On the other hand, the wishes of activist board members add a new agenda for the board meetings and the increased measures that were taken by the government, to protect consumer data, especially after the scandal caused by Facebook.

In theory, the crisis with Facebook’s unauthorized data sharing wasn’t caused by illegal actions however it wasn’t moral behavior either. There was a grey area in the law regarding the use of consumer data and Facebook used it in its favor. Due to this usage, did a foreign country actually interfere with the U.S. elections? As a result, Facebook was fined and lost credibility.

While all this was happening, Facebook’s CEO and Chairman of the Board was the same person. What do you think if they had been two different people, what would Facebook’s behavior have been like then? We will never know the answer because we can’t go back in time. But this demonstrates a way to live our future in a most beautiful/confident way. Another example that has occurred during the COVID outbreak is the independent board member of Boeing, and former United Nations ambassador Nikki Halley, opposing requested government support and offering her resignation due to a conflict of interest with her philosophical principles (5). This resignation is one of the things we should consider when we think about the future.

Returning to our topic, boards have to make decisions under more uncertainty and with more speed. Because technology develops twice almost every eighteen months, investors, shareholders and other stakeholders want to see immediate results. But in return, a board of directors should examine the material on their own sufficiently to make a sound decision and they must be very careful in doing so. On the other hand, in today’s world there practically isn’t any question that Google and Amazon Alexa can’t answer. Therefore, most board members want to reach data directly in real-time and make their analyses. A good example of this is the real- time data used in SAP Board Meetings, which SAP Executive Board Member, Adaire Fox-

Martin talked about during our meeting. Of course, the “live presentations”, which are formed using real-life data and their company’s software and capabilities seems able to support that.

Cumulative data coming to board meetings may sometimes lose importance. Even when reports are checked over and over again and adjusted by senior management, problems in the board’s duty in terms of supervision and accountability can occur. Another issue is some members cannot handle their duties in different boards of directors due to the high amount of information and the effect of real-time (6). For these reasons, how to create the boards, how to run them, and what principles have become important topics of popular magazines, academics, and consultancy companies. For example, the issue of diversity has become very important. However for years, despite discussions on diversity, boards still mainly consist of old, white men. The global reaction to Covid19 and the death of George Floyd have uncovered new opportunities and threats (7).

It is known that in Turkey, I give special attention to the representation of women in board of directors’ and am actively involved as well. According to research performed regarding management, boards that give importance to gender diversity were found to perform better in

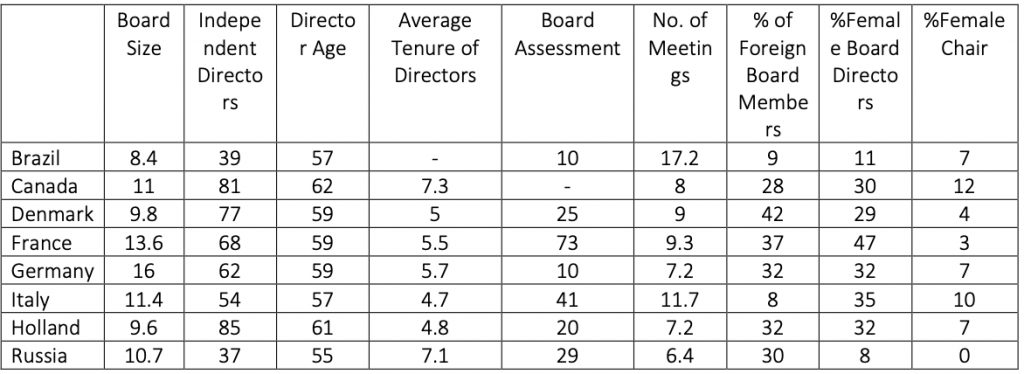

their sector by some points (8). According to other research, globally, only 17% of companies have women working on their boards of directors. If this increase continues at the same rate, gender equality in a board of directors won’t be seen until 2048 (9). For some time in Turkey, surveys have been done regarding women on boards of directors. According to the 2019 report (10), the rate of women in BIST companies’ board of directors’ rate increased by 3.3%, from 15.2% to 15.9%. The proportion of female independent board members increased from 16.6% to 17.7%. Spencer Stuart consulting company’s internet site shows Turkey’s and many other countries’ statistics on boards of directors and is frequently updated. I found these statistics very useful. In Table 1, for example, Turkey’s rate of women on the board of directors can found and although it has increased, it is still not at the desired level (11).

Another important aspect to consider is the economies where there are many family-owned companies like ours as well as preparing the next generation to take over the business without gender discrimination, and the necessity of their education to be competent in governance, even though they may not actively take place in management. I would especially like to

congratulate Zeynep Bodur of TOBB for her awareness and efforts towards this.

Another important issue in the digital age is the rejuvenation of the boards. The reason behind this is the subject of the existence of people who were born in the digital age, who are called “digital-born”, in boards of directors. The average age of board members globally is 60 (12). When we look at the top 500 companies of the US S&P 500, it can be seen that the total of board members under the age of 50 is 5%, and those over 70 are 21% (13). No data is available for Turkey, but I imagine it would be quite similar. According to a study by the consulting

firm Deloitte, again looking at the S&P 500, the rate of board members who are experts in technology is 17% (14). According to the same study, companies that hold the technologist as board members perform 10% better than other firms of the same sector.

Speaking of performing, the whole point is actually here … Why do we need a board of directors?

The reasons are very simple: Getting rid of operational blindness by obtaining different views and benefiting from experiences as well as from a wider perspective, interpreting competitors, consumers, and the market to reach an effective social network and efficient organization. It is possible to summarize the duties of the Board of Directors written in almost every book as follows (15):

1. Identifies, evaluates, and selects CEO candidates.

2. Approves and monitors Strategies and Policies.

3. Approves and monitors the Budget and Annual Operating Plans.

4. Monitors the performance of senior management.

5. Creates Human Resources Plans and makes the organization works effectively, efficiently and maintained, watches reward system

6. Allocates resources and helps decision making;

7. Guides in the realization of Strategies and Policies.

8. Implement governance systems and fair manner for everyone. 9. Audits.

The basis of the need for the Board of Directors should work better, is the desire of companies to become businesses/brands by applying better governance rules with an approach that is disruptive and innovative in comparison to their rivals. Consulting firm Russell Reynold surveyed 750 corporate (supervisory board-level) directors of large public companies worldwide about how they had spent their time over the previous 12 months. Based on their results (according to them), they have identified a group of companies marked as Gold Medal Boards. These companies rate themselves highly efficient in operations and overseeing of a high performing company, one of which has outperformed relevant total shareholder return

(TSR) benchmarks for two or more years consecutively. Compared to other companies, these Gold Medal companies, with regards to strategic planning and operations were found to provide more support to the CEO and senior management to be successful at work. These companies also undergo risk analysis, renewal of board members, and spent more time on their crisis management scenarios. Undoubtedly, the financial report review complies with the laws and regulations. This does not mean that they spend less time working on compliance rather, the boards of these companies do not devote as much time to these issues and use the saved time to focus on more value-add work. For example, Gold Medal Boards are 17% less likely to list financial statement reviews as a top area compared to other companies. So while other boards spend 28% of their time on financial statement reviews, Gold Medal board members spent only 11%. Again, these companies are 8% less likely concerning Audit-Related Activities, and 7% points less likely to identify compliance-related activities than other boards (16). According to the research, when we look at the boards of directors, Gold Medal Boards, most of them say “the big picture is unlikely to be found in the rearview mirror’. These boards of directors consider their most important activities to be looking towards the future, and not the past. For example, more time is devoted to strategic planning, management succession planning and better oversight of M&A transactions and enterprise risk. Board members and committee chairs of Gold Medal Boards act as facilitators, and in this role foster high-quality debate, build trust among directors and management, actively seek different points of view, and ensure the contribution of experience and expertise. So when the Gold Medal boards get together, they produce high value and well thought out decisions. Giving clear feedback to the members of the board about their performance is important. The performance of each member is regularly evaluated by the chair. Here particular attention is given to quality, not quantity. Board members in meetings are active participants, always ready to speak. Active listening is very important. No member is given the feeling of “Nod your head and take your salary” mentality is valid. Differing views and opinions are encouraged (17).

Russel Reynolds examined and reported on the executive board of 162 companies, half of which are family businesses in Europe. He found that 23% of the board of directors in family companies are made of family members and 60% of the board’s chairs are one of the family members respectively. Because, according to the study, family members are afraid of being left out. But

the majority is different, with different expertise of independent members. Their experiences bring different perspectives, family issues outside the board of directors they find very useful for a proper agenda setting for meetings. Especially digital Independent, expert members are strongly recommended for transformation and digital business models (18). The demands of the digital age require different and new practical solutions. External factors with family businesses. It enables non-family companies to meet under the same board of the working system. Modern management is trying to separate the ownership structure and management structure. Family companies still want to control management decisions.

Since firms’ work affects social life and the environment, governments are also making arrangements that affect the board of directors. It has reached the point of being an “Invisible hand”, whatever the ownership structure of the company is, two matters unite in the rules of the boards of directors:

1) Having independent members

2) The CEO and the President being separate individuals (19).

It has been proven that companies with a board of directors’ which consist of members with a CEO and the President as the same person have the weakest corporate governance and worst performance in generating long-term value (20). From 2005 to 2009 in S&P 500 companies in the U.S., the rate of separating the CEO and management in the board of directors increased from 30% to 53%. (21). Since independent members have no economic connections, they can make more objective decisions and make better assessments while at the same time can appraise, which has been proven to be a promoting factor (22). No one is now in the group prefers a member in the interest of another member’s reelection. He or she does not want the power to be collected in one hand. In High-Performance Companies, opposition and disloyalty are distinguished from one another.

Regarding myself, I have always applied the following principles in boards of which I have taken part in:

- I have never decided by voting and no decision has been made by vote. This is because I do not conclude a meeting until everyone has understood and agreed. Regardless of the proportion of the minority share that members represent, when they do not agree, I have never made a decision taking advantage of, or in opposition to them.

- I have never held a meeting without an agenda, performance reports and without preparation.

- The required documents are always sent to the members two days in advance, and the presentation is not repeated in the meeting.

- Consultation and discussion points desired by the Chair and the CEO are specified separately in documentation

- It is determined by the internal audit beforehand that all the documents submitted are correct.

- At the beginning of each meeting, decisions taken in the previous meeting are reviewed, actions are followed and at meetings, everyone is informed about the new decisions taken in the meeting.

- Political and current issues are not on the agenda, but our competitors and the future are discussed.

- Timelines and durations are respected.

- An internal review is made at least once a year and the performance of the board of directors is measured.

- If there is a unique meeting in the board of directors, only the members attend but at other times professional managers are included, even being consulted regarding issues that are of their interest on the agenda

- A lawyer joins the board of directors as a listener and warns if necessary and delivers notes to the corporate secretary.

- Memorandums of board meetings are distributed.

- Only board members without the CEO can hold a closed session at the beginning and end of the meeting.

- For the ease of participation by professional board members in companies with full ownership in the board meetings, a member (Lead Director) is selected to manage the meeting for realistic participation in the discussions.

- When choosing members of the board evaluations are based on the past experiences of the candidates, with particular attention to diversity and contribution.

- While interviewing the candidates, we will not only give them our company profile but also our business philosophy and future thinking. We share our vision and allow them to interview and get to know us.

- An internal orientation program is applied to all members before participation. As an example of all this, one can look at our first global and foreign production sales/distribution company Godiva, purchased in 2008 and how we set it up.

We opened up to the global world with Godiva and this was a first for us. We were 100% owner of the company but since the steps, we would take would be creating a transparent, accurate, trustworthy institutional impression we wanted to be sure, and that was of the utmost importance. Although the owner of a company had offered more money than us, the seller didn’t trust and therefore could not entrust the company and its employees to our competitor. However, he trusted us. We undertook a great responsibility. On the first board of directors, I was the chair and from the family, Ali Ulker, the CFO of Yıldız Holding, the Head of Foreign Trade, the CEO of Godiva, and 6 independent members. These members were former Tusiad President, former THY CEO, former Burberry CEO, former Body Shop Chairman, former PG top executive, and a member from Istanbul Chamber of Industry Assembly. They were all with international and retail or FMCG experience. In the future, some of the people have changed, however, we have always kept this type personalities and capabilities on the board. The management of Godiva according my desire for diversity and institutionalization as the chairman, was benefiting from the opinions of the board members and listening to their free will and ideas. I have appointed an experienced member, (chairman of Body Shop) as “Lead Director” to encourage and manage

meetings. Thus, not only board members but the same Company executives such as the CEO, CFO, CMO, who also attend the meeting are also sharing. The only thing left for me to do besides, at the beginning and end of the meeting, is to lead closed consultation sessions and listen patiently during the other phases of the meeting. Of course, during the year, attending the board meetings held all over the world has been very useful for me to visit our facilities and markets, which I call “GOYA”.

An important issue; when the CEO presents on their strategy and alternatives, then have the board discuss and criticize and let the CEO come up with alternatives and ask to the board of directors provide support. The board and the chairman should not see themselves as the boss of the CEO. If the boss of the CEO is the board of directors, who is the boss of the board? The answer depends on whether the company is a family company or a stock company, but in management, it should not be forgotten that the established partners are representatives rather than themselves. Roles should not be confused (23).

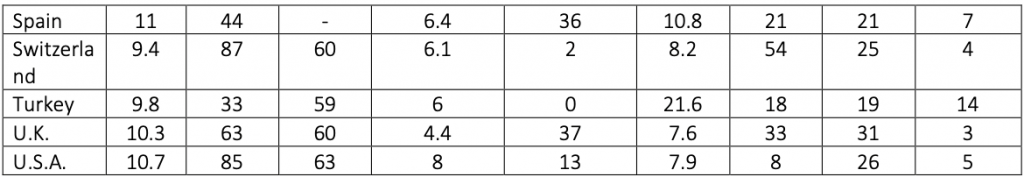

Finally, INSEAD Corporate Governance Center launched a research project including a survey of 200 boards from 31 countries, with 80 Chairs and 60 board members including board members, shareholders, and CEO in-depth interviews. When we look at the results of the interviews, in this research, “How to be a good chair?” was answered and the results are as follows: ‘An effective chair is a guide on the side; shows the way, but doesn’t lead; restraint; is patient; is available whenever needed; encourages teaming not team building; has the preparatory work done; takes committees seriously, remains impartial; and deals with people, agendas, materials, processes and time, measuring input not output’.(24)

Table 1: Board statistics by country

Source: https://www.spencerstuart.com/research-and-insight/boards-around-the-world 2020.

Table 2: Elements that make the Chairman of the Board successful

Source: Shekshnia S. How to be a good board chair? HBR, March-April 2018

The numbers vary a lot according to countries. This may be due to culture. But then, what will be the measure of the board of directors in our search for diversity and innovation in our global business? How should we set goals?

For example, Shekshnia states, for an effective board, the maximum airtime of the chair is 10% of the total time. However, the frequency of meetings according to the different countries is so varying that the chair’s airtime during meetings in one country’s time is equivalent to the entire meeting time in another country!

So how will it work? Of course, this is a joke, but the numbers in these two tables are enough to show us that this subject should be investigated further?

References

1) Özel M., Ülker Modeli Toplantı, Yeni Şafak, 2006.” Sabri Ülker’in Hayat hikâyesi: Akşama Babacığım Unutma Ülker Getir, by Turgut Hulusi, Dogan Kitap, 2014.

2) Wursching F.T. (Editor), Independent Board Member, Hayat, 2012.

3) Arguden, Y., Secrets of the Board of Directors, Rota Publications, 2007.

4) ‘The next catastrophe (and how to survive it)’, The Economist, 27 June 2020.

5) Josephs, Leslie. “Former UN Ambassador Nikki Haley Resigns from Boeing Board, Opposing Government Aid.” CNBC, CNBC, 20 Mar. 2020, www.cnbc.com/2020/03/19/former-un-ambassador-nikki-haley-resigns-from-boeing- board-opposing-government-aid.html.

6) Stafford B., Schindlinger D., Governance in the Digital Age, Wiley, 2019.

7) Pitcher, H. Diversity and Inclusion, Advance Boardroom Excellence, 2020.

8) Tapper, Charlie. “Diversity and Inclusion – The New Realities and Opportunities.”Advanced Boardroom Excellence, Advanced Boardroom Excellence, 30 June 2020, www.abexcellence.com/articles-list/2020/1/7/diversity-and-inclusion-the-new-realities- and-opportunities.

9) Eastman M.T., Rallis, D.; Mazzucchelli, The Tipping Point: Women on Boards and Financial Performance, MSCI ESG Research, LLC., Dec. 2016; https://www.msci.com/documents/10199/fd1f8228-cc07-4789-acee-3f9ed97ee8bb

10) Stafford B. et al., ibid., s. xxii.

11) Women’s 2019 report on the Boards of Directors in Turkey, Turkey Female Directors Conference, Sabancı University, 2019.

12) “Boards around the World.” Spencer Stuart, www.spencerstuart.com/research-and- insight/boards-around-the-world?category=all-board-composition&topic=all-topics.

13) Stafford B. et al., ibid., s.xxiii.

14) “Bridging the Boardroom’s Technology Gap.” Deloitte Insights, www2.deloitte.com/us/en/insights/focus/cio-insider-business-insights/bridging-boardroomtechnology-gap.html.

15) Bowen, G. William, Board Book, Norton, 2008, pp. 19-38. 16) “2019 U.S. Spencer Stuart Board Index.” Spencer Stuart, www.spencerstuart.com/research-and-insight/us-board-index.;Ethicalboardroom. “Board Refreshment: New Paradigms for Board Effectiveness.” Ethical Boardroom, 12 Nov. 2017, ethicalboardroom.com/board-refreshment-new-paradigms-for-board-effectiveness/.

17) O’Kelly III. R., and Neal PJ. Top Boards Do These 4 Things Differently, HBR, February 10, 2020.

18) Bellini Beatrice, Every Family Business Needs an Independent Director, HBR, January, 27, 2020.

19) James, P., Understanding the Impact of Board Structure on Firm Performance: A Comprehensive Literature Review, International Journal of Business and Social Research, 2020.

20) Rechner, P.L., Corporate governance: Fact or fiction? Business Horizon, 32 (4), 11-15., 1989; Rechner, P.L., and others, ‘CEO duality and organizational performance: A longitudinal analysis’, Strategic Management Journal, 35 (5), 1010-1035, 1991.

21) Mandalo, J., Devine W., ‘Why the CEO shouldn’t also be the Board chair’, HBR, March 4, 2020.

22) Fama, E.F., Agency problems and the theory of the firm, Journal of Political Economy, 88(2), 288307, 1980, Fama, E.F., et al. Separation of ownership and control, Journal of Law Economics, 26, pg. 301-325, 1983.

23) Martin, R. ‘The Board’s Role in Strategy’, HBR December 28, 2018. 24) Shekshnia S.,‘How to be a good board chair?’ HBR, March-April 2018