In November 2020, Scott Galloway, a professor at New York University, published a very interesting book titled “Post Corona / From Crisis to Opportunity”. Galloway is someone who has worked in the advertising and marketing sectors for a long time, founded companies, has done research, but like the most “left-leaning” employees in the sector, he later moved on to university and seems somewhat opposed to the advertising/marketing industry. Galloway talks about the effects of the pandemic on the USA completely in the book, but his analysis is actually valid for the whole world because the pandemic caused the same problems in almost all countries, even if the countries’ solutions are different.

“I begin with two theses. First, the pandemic’s most enduring impact is accelerating the existing dynamics… Second, in any crisis there is opportunity; the greater and more disruptive the crisis, the greater the opportunities. However, my optimism on the second point is tempered by the first – many of the trends the pandemic accelerates are negative and weaken our capacity to recover and thrive in a post-corona world.’ says Scott Galloway.

And then Galloway tries to prove his theses:

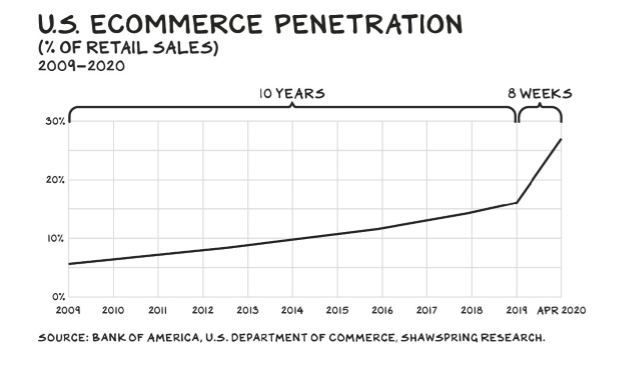

The first example is that since e-commerce took root in 2000, e-commerce retail share has grown by roughly 1% each year. At the beginning of 2020, about 16% of the retail industry was traded on digital channels. Eight weeks after the epidemic reached the USA (mid-March-April), this number jumped to 27% and will not decline. E-commerce has achieved 10years growth in just 8weeks.

Take any trend – social, business, or personal – and fast-forward ten years. Even if your firm isn’t there yet, consumer behavior and the market now rest on the year 2030 point on the trend line – positive or negative. In this case, if your company has a weak balance sheet, it is no longer recoverable. If you are in the basic necessities business in retail, your products are now more necessary, but if you are in the non-essential consumer goods business, the products you sell are no longer necessary, so you have to work harder to create a demand for them.

The second example: For decades, companies have invested in equipment for virtual meetings with a desire for rapid development; Universities invested heavily in technology to catch up with the times, including programs like blackboards. Advertisers tried hard to promoted digital technology, virtual meetings, distance education, and distant healthcare services. However, there was no improvement. They continued to hold company meetings face-to-face and personally attended company meetings by traveling long distances. Universities still haven’t gotten beyond the pen-written board and power-point. The hospitals continued to work in the same way. All these technological innovations were kept on the sidelines without being used. But with the epidemic, tens of years of development were achieved at once within weeks. People’s relationship with technology was suddenly based on year 2030 predictions.

The third example: It took 42 years for Apple to reach a value of $ 1 trillion. But that number doubled between March and August 2020. So 20 weeks was enough to reach another trillion dollars; for decades, mayors and planning officials of major cities have called for the use of bicycles instead of cars to purify the air. During the epidemic, people preferred bicycles to public transport. Within a few weeks, a reduction in air pollution, a reduction in carbon footprint, which had not been achieved for decades were achieved.

The concept of economic inequality, which economists have been warning about for decades, has suddenly, become noticeable. It is only now understood that income inequality is more a dystopia rather than an utopia. Due to the epidemic, at least one person in half of US households lost their job or experienced a salary cut. Households with an annual income of less than $ 40,000 were the most affected, with almost 40% losing their jobs in early April.

All these negative situations experienced in the pandemic provided very useful transitions in people’s perception of telehealth services, universities’ attitudes towards distance education, and in structuring the approach of markets to order delivery.

Galloway then fiercely criticized the United States: “Despite our belief that we spend more on healthcare than any other nation and that we are the most innovative society in history, we are one of the countries with the most losses. It took only 10 weeks for us to drag 40 million to disaster against the 20 million jobs we have created in the last 10 years. Travel is prohibited, restaurants are closed, and the sales of liquor and weapons have increased. More than 2 million Generation Z have moved in with their families, and 75 million young people are going to school amid uncertainty, conflict, and danger. Our response to this crisis has not been successful.”

“One of the most surprising aspects of the Covid crisis has been the resilience of capital markets,” says Galloway and he further sheds light on the effects of the pandemic on the economy: “After a brief decline when the pandemic turned into a pandemic, the major market indices Dow Jones, S&P 500, NASDAQ Composite are back to their original state. Despite the deaths of hundreds of thousands of people in the US and record unemployment, they were able to recover most of the losses. There is also no sign that the virus is declining. On the cover of June, Bloomberg Businessweek put the title “The Great Break” in its report. The magazine writes that Wall Street professionals were stunned. Although 1000 people died in the USA every day, the rise of the markets continued.

As a result of the recovery, several large companies, especially large technology companies, had excessive profits. Small and medium-sized companies were not able to benefit from this recovery, and medium-sized companies shrank by 10%, while 600 smaller companies from the S&P 600 index shrank by 15%.

There are quite surprising names on the bankruptcy list given by Galloway, who says that the long list of bankruptcies in the US is shocking. ”Neiman Marcus, J.Crew, JCPenney, Brooks Brothers, Dollar, and Thrifty owned Hertz, Lord & Taylor, True Religion, Lucky Brand Jeans, Ann Taylor, Lane Bryant, Men’s Wearhouse and John Varvatos, 24 Hour Fitness, Gold’s Gym, GNC, Dean & DeLuca, Muji, Chesapeake Energy, Diamond Offshore, Whiting Petroleum… Reservation companies, entertainment, airlines, cruises. The number of casinos, hotels, and resort companies decreased by 50%. Tesla increased 242% while GM dropped 31%. Amazon rose 67% and JCPenney went bankrupt. Those who win today are likely to be more successful tomorrow, “continues Galloway.

As a result, with the policy decisions taken by the United States government, 2.2 trillion dollars entered the economy and this flowed largely to the capital markets. Therefore, companies that performed well before the pandemic benefited significantly from this worldwide crisis. But others were deprived and their situation worsened.

For example, airlines were not in a position to survive after this epidemic in its current form. Many airlines, including Virgin Atlantic, went bankrupt. But I guess none of them will go bankrupt because the US Congress gave these companies $ 25 billion in April 2020 and probably will give more.

At this point, he makes the following striking determination: “Cash is also king in the pandemic. Companies with strong balance sheets, cash, cheap debt, and especially low fixed expenses will survive. Costco maintains its place after the pandemic with 11 billion, Honeywell 15 billion, Johnson & Johnson 20 billion dollars. An oligopolistic formation may occur in every category. “

We are in the product age now, and what we’re going to talk about is new advertising models. Radio advertising fell 14% in 2020. In 2021, it is estimated that the Google-Facebook duo will dominate 61% of the digital advertising market. There will be a high rate of natural selection among US media firms.

Marketers think that people want to choose. Yet consumers don’t want more choice. They are more confident in the options available to them. Customers want someone else to do the research and choose the options for themselves. The only thing left for them is to enjoy the moment.

There are two main business models, says Galloway. First, a company sells its goods for more than the cost of production. This is what is expected. Second, a company sells you something for less than its cost and exchanges it for the consumer behavioral data it obtains to from other companies. Then all of a sudden these companies have all the data that what we read, where we shop, who we talk to, what we eat, how we live, and so on and they process it, sell it. Watch out, free is the most expensive. If something is free, I guess you are the product.

In the first five months of the Covid19 outbreak, the market value of nine major technology companies increased by $1.9trillion. These were not pharmaceutical and healthcare companies. The Big 5 Microsoft, Amazon, Apple, Facebook and Google; the value of these five companies increased by 24% in mid-2020. From the beginning of the year to the middle of August, a value increase of 2.3 trillion dollars was achieved and value increased by 47%. The combined value of these five companies is unprecedentedly 21% of the value of all publicly traded US companies. Unbelievable!

The dominance of big technology is no surprise. Normally, companies that are rising at such a fast rate are expected to decline rapidly. However, this time it probably won’t. These companies are now the playmakers of the future. Amazon, Apple, Facebook, and Google started early. Now their size is their strong advantage.

Leadership is the ability to persuade people to work together for a common goal. Facebook and Google offer a combination of scale and detailed structure unmatched by anyone else as a competitive advantage.

Another advantage for Facebook and Google; these two companies are growing by taking advantage of fake news. In the pandemic, this increased even more and this time it turned into false news about the pandemic.

The opportunity for disruption in a sector is a dramatic increase in price without an increase in value or innovation. This is also known as an unearned margin. For example, the price of universities has increased by 1400% in the USA in the last 40 years. Health services is another industry that is likely to be up and down. Another factor is to rely on brand value, apart from product quality and distribution. However, the transition from the brand age to the product age will erode the competitive advantage of any of these companies. Many companies sell a mass-produced, mediocre product, but some people believe in these products because of the investment in branding for generations. Digital technologies are an innovative category. Now people are more concerned with the service quality than the brand value of the product. Everyone has to think about what service they can offer, no matter what they sell. It should be cheap, high quality and fast.

The author then focuses on startups that upset the capital market. It touches on unicorns but I think unicorns should be handled exclusively. I also exclude the author’s comparison with the American Dream, the new phases of capitalism, and Northern European Socialism for the time being. But I cannot pass without citing this determination: “I also discovered that most of the super-rich are patriotic, generous and genuinely interested in their state’s wealth. This makes sense because reaching the top is only possible when people bring you there. But wealthy people, like everyone else, first think of themselves and their loved ones”.

There is something I learned from my late father, Sabri Bey: “You are not as rich as your money in your pocket, but as rich as your family and friends around you. It doesn’t matter what I or anyone else owns, or how rich they are, as you phrase it. What matters is what my country and nation have … I think this is the greatest wealth”.

Galloway says big technology is no longer willing to innovate. There is a much more profitable opportunity. Data Exploitation! Over the past decade, we have shifted from an innovation economy to a data exploitation economy. There is no such thing as a free social networking app. Companies are increasingly using algorithms to take advantage of human weaknesses. Most human illnesses and difficulties arise due to famine, e.g., little salt, little sugar, little fat, and little safety. As a result, when we get these, our brain produces the ultimate reward, the dopamine hormone, and is happy. In other words, survival and reproduction are rewarded. This is the key point.

Note: This article is open source and can be cited by mentioning the author. Does not require copyright.

Bibliography

(*) Galloway, S., Post Corona: From Crisis to Opportunity, Penguin, 2020, 175 pgs.